How much mortgage can i borrow on my salary

Your salary will have a big impact on the amount you can borrow for a mortgage. Compare Lowest Mortgage Lender Rates Today in 2022.

How Much Mortgage Can I Get For My Salary Martin Co

Compare Mortgage Options Get Quotes.

. Depending on a few personal circumstances you could get a mortgage. For example some experts say you should spend no more than 2x to 25x. This mortgage calculator will show how much you can afford.

Ad Compare More Than Just Rates. Typically you can borrow up to 45 times your income for a mortgage. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. If your salary was 40000 per year for example you may be able to borrow 180000. Ad Top-Rated Mortgage Rates 2022.

You typically need a minimum deposit of 5 to get a mortgage. Most future homeowners can. You can calculate how much.

Ad More Veterans Than Ever are Buying with 0 Down. Learn more about reverse mortgages and what to expect from them. The up-front premium is calculated based on the homes value so for every 100000 in appraised value you pay 2000.

Experts recommend that the monthly cost of the loan should not exceed 30 of the buyers income. Find A Lender That Offers Great Service. Get Started Now With Rocket Mortgage.

Apply See If Youre Eligible for a Home Loan Backed by the US. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. Thats 6000 on a 300000 house for example. For instance if your annual income is 50000 that means a lender.

How much mortgage can you borrow on your salary. Ad A reverse mortgage is a loan. For home prices 1.

The first step in buying a house is determining your budget. Get Top-Rated Mortgage Offers Online. But this will vary depending on the lender and the.

The APR on a 30. What More Could You Need. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

Calculate what you can afford and more. You are borrowing against your home equity. How much can you borrow salary.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. Find out more about the fees you may need to pay. Generally speaking the higher your income and credit score and the lower your debt-to-income ratio the more money youll be able to borrow for a mortgage insurance.

How many times my salary can I borrow for a mortgage. How much mortgage can you borrow on your salary. Can I borrow 45 times my.

You could borrow up to. What More Could You Need. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

What mortgage can I afford on 70k. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Generally lend between 3 to 45 times an individuals annual income.

This mortgage calculator will show how much you can afford. Youll need a larger deposit. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income.

How much mortgage can I borrow with my salary. Alongside the normal affordability criteria youll need to consider. Check Eligibility for No Down Payment.

The average 30-year fixed-refinance rate is 632 percent up 21 basis points compared with a week ago. Thats a 120000 to 150000 mortgage at 60000. Get Started Now With Rocket Mortgage.

BTL mortgages are considered a little riskier for lenders which means youll. Most lenders cap the amount you can borrow at just under five times your yearly wage. Compare Mortgage Options Get Quotes.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. See How Much You Can Save.

For you this is x. In a practical example. Mortgage lenders in the UK.

How much can you borrow. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Fill in the entry fields. How much do you have for your deposit. Find all FHA loan requirements here.

Ad Are you eligible for low interest rates.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

![]()

How Much House Can I Afford Interest Com

What Is It Like To Be Saving 70 Of Your Salary Quora

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Home Loan Can I Get On My Salary In Dubai

How Much House Can I Afford Calculator Money

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Savings Calculator Excel Template Spreadsheet Savings Calculator Saving For Retirement

How Much Can I Borrow On A Mortgage Based On My Salary

2021 Fdic Insurance Limit And How To Maximize Coverage Smartasset Assegni Funziona Assegno

How Much Mortgage Can I Afford

35000 A Year Is How Much An Hour Good Salary Of No Money Bliss

How Does My Salary Affect My Mortgage Amount Articles Mortgages Online

How Much Personal Loan Can I Get On My Salary Check Salary Range

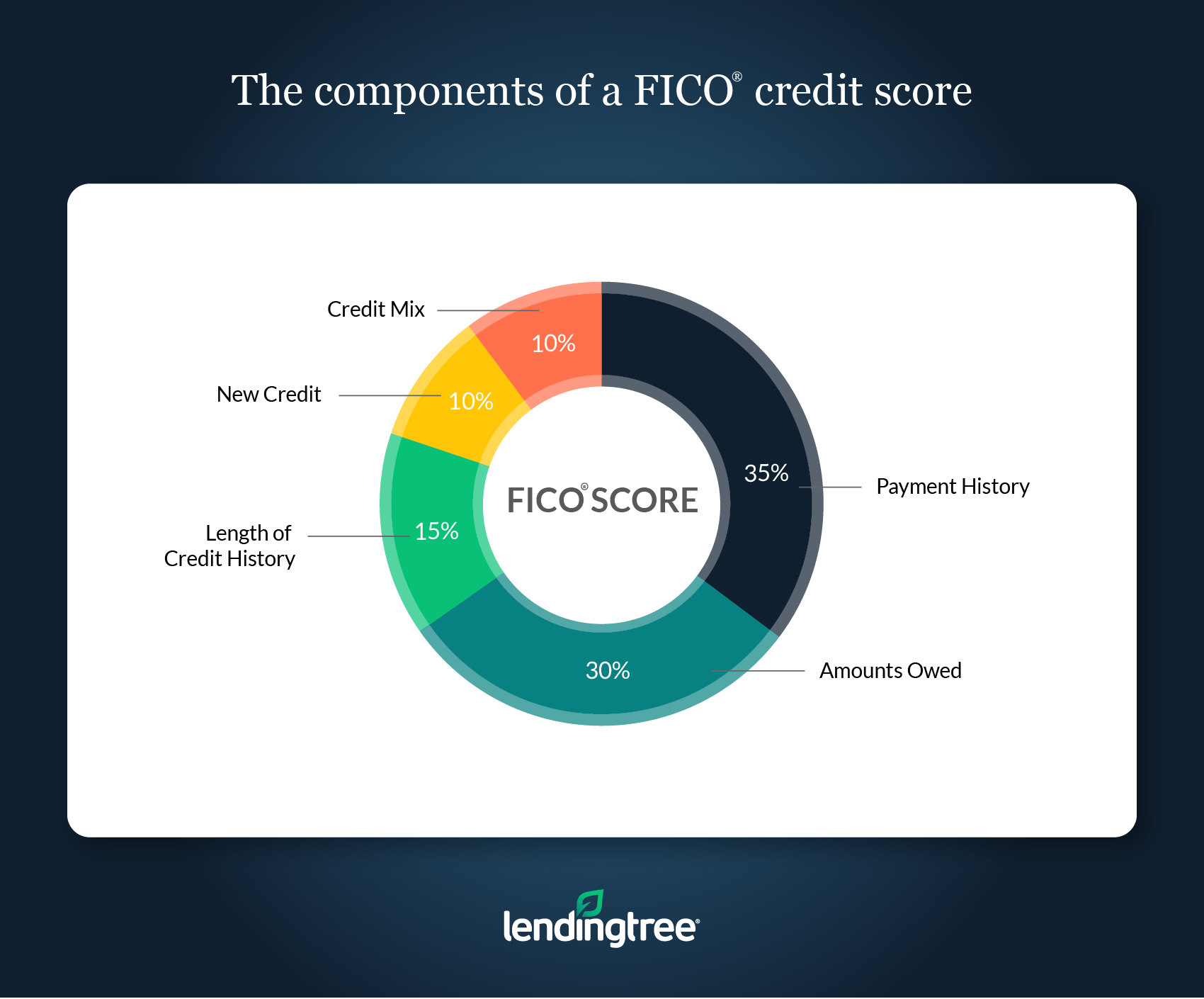

How Salary And Income Affect Your Credit Score Lendingtree

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Home Affordability Calculator Credit Karma